(Editor’s Note: Dan Munro writes for Forbes under the heading, HealthCare Compass).

(Editor’s Note: Dan Munro writes for Forbes under the heading, HealthCare Compass).

If there’s a single piece of architecture that symbolizes our ”Down the Rabbit Hole” view of healthcare pricing – the Lou Ruvo Center for Brain Health in Las Vegas, Nevada (designed by Frank Gehry) is a pretty good candidate. While both the building and hospital pricing are equally provocative, it can be daunting to make any real sense of either.

The snowball started, of course, with Steven Brill’s Time Cover story – Bitter Pill: Why Medical Bills Are Killing Us (March, 2013). The evidence was shocking – but anecdotal and not really broad enough to call systemic.

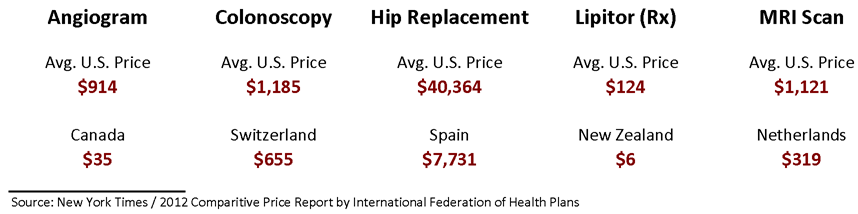

Then came the release of hospital pricing by the Government which included Medicare billing data from over 3,000 hospitals (May, 2013). In June, The New York Times added even more evidence with ”The $2.7 Trillion Medical Bill” (here) which included a version of this chart:

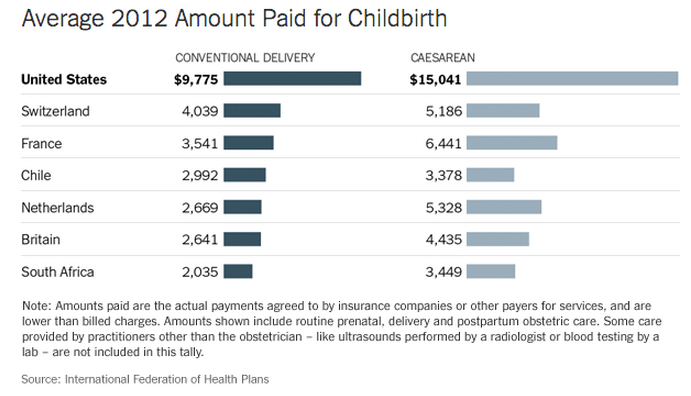

Also in June, The New York Times released another data point – American Way of Birth, Costliest In The World (here) that included this chart:

The evidence of exorbitant pricing is clearly overwhelming – even if it’s not new – or newsworthy. Looking at the raw data, many will assume that pricing transparency will bring much needed competition to an isolated (and opaque) market – and that exorbitant pricing will quickly collapse. The key assumption to that narrative, of course, is that hospitals are lucrative and have sufficient capacity to flex pricing quickly in order to avoid a perception of “medical gluttony” (as originally outlined by Dr. Otis Brawley here).

Certainly some hospitals are wildly profitable, but many are not. According to Delos Cosgrove (CEO and President of Cleveland Clinic) almost a quarter of American hospitals are losing money.

“Healthcare is a low-margin economic activity. Almost a quarter of American hospitals are already losing money. With that number bound to increase in coming years, we already know what to expect because we’ve seen it before in the airline, supermarket, phone and electronics businesses. There will be a wave of mergers and acquisitions to improve quality and lower costs.” Delos Cosgrove, M.D. – CEO and President at Cleveland Clinic (Article: The Great Consolidation Begins)

This somewhat ominous forecast for American hospitals is the more logical narrative and one that is also supported by global consultancy L.E.K. Consulting.

“According to L.E.K. Consulting’s analysis, the net impact of legislative, structural and demographic factors will be materially negative on most hospitals in the country.” Hospital Economics and Healthcare Reform: No Free Lunch (In Fact, I Might Go Hungry) – L.E.K. Consulting

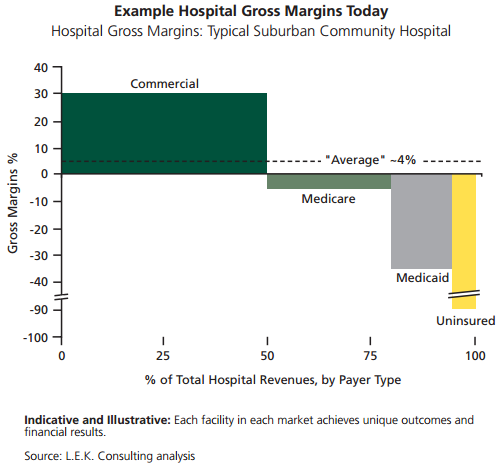

The case that L.E.K. makes is compelling because it highlights what many already know to be true about hospital pricing. Namely that while exorbitant pricing is certainly provocative (now that some of it is finally visible), it is actually well founded on hardcore economic realities. Those realities are based on the cost-shifting (different from price discrimination) that many hospitals must undertake just to maintain the “low-margin economic activity” referenced by Dr. Cosgrove. That costshift is best reflected in the opening chart of the L.E.K. report (Figure 1 – page 2).

At least according to L.E.K Consulting, 50% of hospital revenue is relatively profitable (Gross Margin of about 30% for our “sample” suburban community hospital). The challenge is that other 50% – which all arrives with varying percentages of loss. That’s the baseline for L.E.K’s forecast ahead.

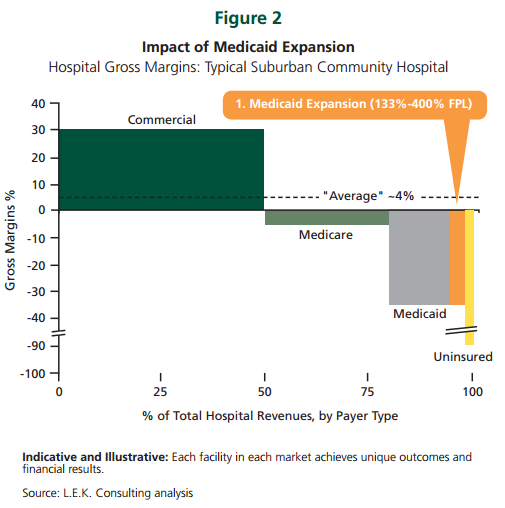

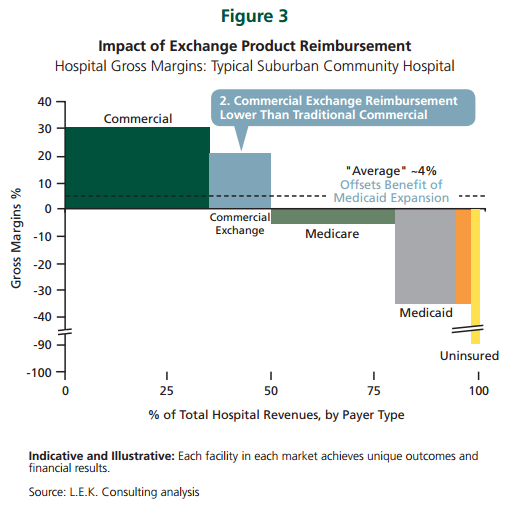

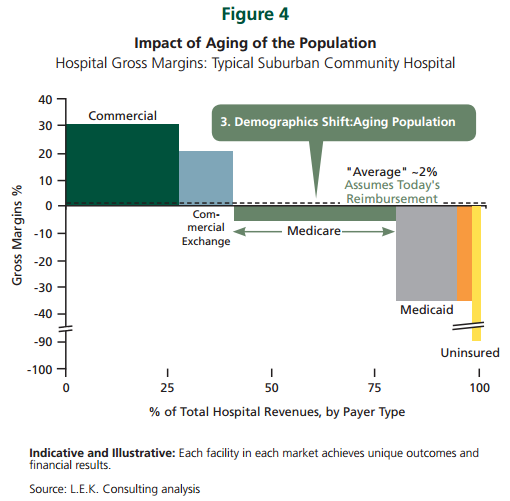

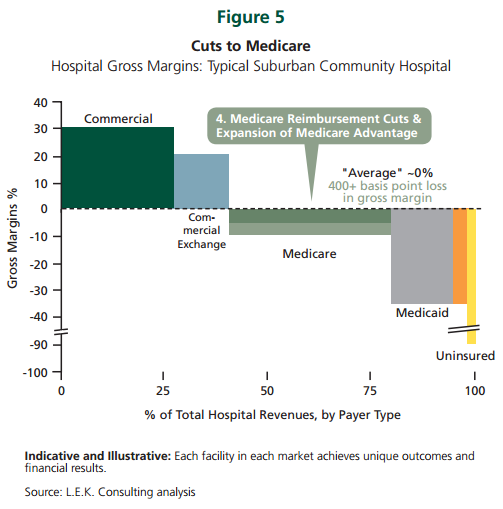

Figures 2 thru 5 show the cumulative effect of “legislative, structural and demographic” changes either underway – or pending. The individual components include Medicaid Expansion, Reimbursement through Exchanges, an aging population (about 10,000 people a day turn 65), and pending Cuts to Medicare.

All of which suggests that whatever we may think of exorbitant hospital pricing, at least according to one global consultancy, the forecast ahead won’t include dramatically lower prices. What seems to be more likely is what Delos Cosgrove suggested in his article from March – an era of consolidation.

“Bigger isn’t always better, but when it comes to healthcare we’re finding that it usually is. Doctors, hospitals and medical centers across America are looking for ways to collaborate, consolidate and merge their resources. They’re discovering that high volume medical centers can produce better outcomes for many procedures, and more effectively and efficiently provide care across a whole spectrum of services. Medicine is becoming a team sport.” Delos Cosgrove – CEO and President at Cleveland Clinic (Article: The Great Consolidation Begins)