Editor’s Note: Dan Munro is a contributing editor to Forbes. His columns are collected under the heading, “The HealthCare Compass”.

Editor’s Note: Dan Munro is a contributing editor to Forbes. His columns are collected under the heading, “The HealthCare Compass”.

Last month’s article by Steven Brill in Time magazine (Bitter Pill) brought painful and much needed transparency to the topic of healthcare pricing. The biggest single topic and buzzword at HIMSS13 in New Orleans was unveiled earlier today – interoperability. For the rest of us – that word refers to how the healthcare industry exchanges patient data safely and securely. I’ll provide the cliff notes – it doesn’t. At least not easily. For decades the healthcare IT (HIT) industry has been mired in the politics and profits of getting even basic patient information from point A to point B. In a wild attempt at using all of us as digital Sherpas – even the mighty tech giant Google tried their hand at a patient-facing health record (called Google Health) which they completely shuttered earlier this year.

Without going into the evolutionary history of healthcare IT, it’s easy to understand the complexity surrounding all the failed attempts. The pitched battle around HIT profits makes any data exchange a monumental – some would say impenetrable – gauntlet. In healthcare, patient data is patient ownership and as we learned from Steven Brill – that wildly lucrative chargemaster price has to be applied to something. That something is the patient record. Sharing that record – in any direction – is significant risk for many business and legal reasons. Here are just a few:

- Over 300 Electronic Health Record (EHR) vendors (with salaries and profits aplenty)

- A combination of structured and unstructured data (with hundreds of proprietary data formats)

- The need for “trusted” (think ”chain of custody”) data for the safe transfer of clinical risk and legal liability

- Almost 3 million physicians, nurse practitioners and pharmacists either creating or editing patient data

- A lmost 6,000 hospitals and over 1,000 healthcare insurance companies nationally (managing and storing the data)

- Over 300 million (potential) patients and over 1 billion discrete patient events per year

- No National Patient ID (12-15% of hospital errors are related to patient identification)

- Regulatory requirements (and penalties) with very real (often individual) consequences

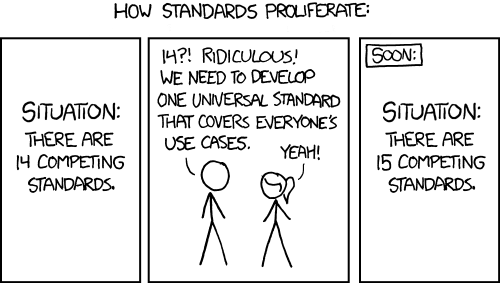

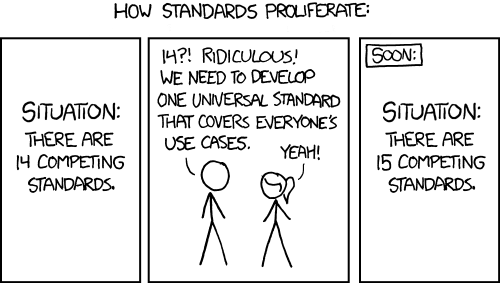

- Standards that have used the xkcd model of proliferation – for decades:

It’s easy to see how there’s almost no hope of easy or efficient data exchange here and why paper records and fax machines remain the “lingua franca” for many healthcare professionals – to this day. Earlier this morning, 5 of the larger HIT vendors announced a collaborative effort around data exchange called the commonwell Health Alliance. It’s an encouraging step by some of the larger HIT vendors including McKesson, Cerner, athenahealth, Greenway Medical and Allscripts – but it’s still reliant on a cumbersome workflow – around tightly-coupled data exchange – between a handful of tech-titans – in a community of over 300 vendors (the largest of which – Epic – was noticeably absent).

With their announcement today, Verizon is launching a new private data exchange platform called Secure Universal Messaging Services (SUMS) which is designed to scale quickly – in much the same way that new “apps” scale on the consumer side. In private beta for several months, the solution adds an easy to use service that bridges all the security, regulatory and authentication requirements of healthcare with the elegant simplicity of an email interface. Any legally registered healthcare practitioner (as identified through either the DEA or NPI Registries) can sign-up and use Verizon’s industrial strength security and authentication to safely send messages (with any file-type attachment) to any other registered healthcare practitioner. It’s analogous to GMail – baked specifically for healthcare practitioners. Rather than try – or more likely wait – for tightly coupled data exchange (years of debating, development and legal agreements), Verizon’s new service is modeled with the technical and financial simplicity of GMail. Over time, the idea is to extend the use with tighter data exchange through API’s already under development.

It’s a bold and simple bet. Secure identity management and network authentication of the healthcare practitioner (from a trusted source – at scale) trumps proprietary patient data. Verizon’s delivery advantages around this exact kind of service are significant. First, the scale is truly global and extends from the largest datacenters to the smallest devices. Second is a vendor neutrality that can deftly neutralize any reluctant (or recalcitrant) healthcare IT vendor, and third is a rich history of domain expertise specifically around industrial-strength network security, identity management and authentication (at scale). An early ”beta” user is Avera Health – a regional healthcare delivery network based in South Dakota.

“We’ve only been using the Verizon Beta service for a few days, but in our world we have to communicate with about 75-100 different hospitals across 6 different states. Email is the perfect initial step that makes it bone simple for everyone to safely and securely exchange patient information quickly. Everyone knows how to use email and the Verizon brand gives us the confidence to know that we have a large-scale technology partner that transcends the business-as-usual models and bureaucracies typically designed to protect legacy IT vendors.”

Donald Kosiak, MD, MBA, FACEP, Avera eCare Medical Director

The two analysts I spoke to were equally optimistic:

“Verizon is one of several very large vendors that are moving to become national providers of health information exchange rather than providing technology to community-based providers. Other vendors include Covisint, Epic, RelayHealth, Surescripts and a collaboration of vendors that also announced earlier today at HIMSS [see commonwell Health Alliance here]. Each vendor is seeking to leverage its intellectual property to bypass the laborious work of managing the identities of healthcare providers and patients and to use its market dominance to engineer working interfaces with more EHR vendors. The “network effect” favors vendors that amass market share quickly even if they start by providing a limited set of services. If Verizon can execute on its vision it is well-positioned to come from nowhere and become a significant player in the market.”

Wes Rishel, VP and Distinguished Analyst at Gartner

“The list of vendors that can actually deliver on a secure and effective communications solution like SUMS is pretty short. For this kind of healthcare-specific solution, a provider needs industrial strength domain expertise to meet big technical challenges – at scale – combined with the resources to position and then sell the solution to what is a very complex and highly fragmented market. The provider also needs to have at least some vendor neutrality and a business commitment that extends to include many different healthcare constituents – specifically the small (or even solo) provider. This makes Verizon’s announcement today really compelling – and timely.”

Amy DeCarlo – Principal Analyst, Security and Data Center Services – Current Analysis, Inc.

Interoperability may be this years buzzword at HIMSS, but Verizon is the only one bringing identity management, authentication and network security (at scale) to the party in New Orleans. It’s both exciting and intriguing to see a BIG mobile health solution arrive at HIMSS but I’m pretty sure it wasn’t the one everyone was expecting. In our never ending quest to layer acronyms on tech metaphors maybe next year we’ll see the consumer version as VMail?

UPDATE: Additional coverage by Forbes colleague Matthew Herper here.