When a patient needs medical treatment of any kind, their insurance company needs a way to establish how much they’re going to pay for the services. An insurance company may review a treatment or procedure to determine if it is appropriate, and therefore, if they’ll cover the cost.

When a patient needs medical treatment of any kind, their insurance company needs a way to establish how much they’re going to pay for the services. An insurance company may review a treatment or procedure to determine if it is appropriate, and therefore, if they’ll cover the cost.

When a patient needs medical treatment of any kind, their insurance company needs a way to establish how much they’re going to pay for the services. An insurance company may review a treatment or procedure to determine if it is appropriate, and therefore, if they’ll cover the cost. If an insurance company denies coverage, a patient or healthcare provider can appeal the decision. Utilization Review and Independent Review Organizations (IRO) can help payers, patients and physicians get their needs met.

When a patient needs medical treatment of any kind, their insurance company needs a way to establish how much they’re going to pay for the services. An insurance company may review a treatment or procedure to determine if it is appropriate, and therefore, if they’ll cover the cost. If an insurance company denies coverage, a patient or healthcare provider can appeal the decision. Utilization Review and Independent Review Organizations (IRO) can help payers, patients and physicians get their needs met.

Utilization Review | Review & Management

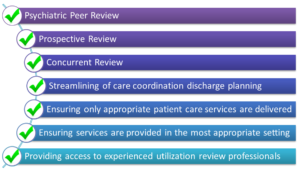

Utilization review can be subdivided into two types: review and management. Utilization review typically occurs retrospectively, that is, after a treatment has already occurred. Using physician documentation and other medical records, this retroactive review can be used to determine also a patient’s discharge disposition. Utilization management, on the other hand, usually occurs concurrently with an admission. Period review by hospitals staff can help to assess the patient’s care from admission to discharge and decrease the likelihood that the insurer will deny coverage.

Insurance companies typically have very clear guidelines in reference to their coverage for treatment. A patient has the ability to review these guidelines, as do physicians, and they can get a clear picture of what their insurance will agree to cover in the event they need treatment. If a patient has a chronic condition that needs ongoing management, they can also review how their insurer covers patients with that specific condition.

When the physician is notified of an insurer’s determination (whether or not they will pay for the services) they will have the ability to appeal the decision. They also have the option of going through an Independent Review Organization.

Utilization Review | Independent Review Organizations

An Independent Review Organization (IRO) can act as an intermediary between patients and insurers. These are third party companies that can facilitate the review of records and help insurers establish treatment guidelines. They can also flip to the other side of the coin and help patients to navigate claims. An IRO can be an asset to both the insurance company and the patient when it comes to navigating the intricacies of medical necessity.

Medical necessity is the basis on which insurers decide what services, and how much of the cost, they will cover. Generally speaking, medical necessity answers the question, “Did the patient need the treatment they received?” This is supported by the documentation the physician does in the patient’s medical record. Sometimes, though, a medial necessity denial happens not because the patient didn’t need the treatment, but they might have received that treatment in the wrong setting. For example, they received treatment as an inpatient, but they really could have had it on an outpatient basis. This means that the insurer doesn’t believe they really need to cover the costs associated with an admission. A patient and physician can appeal this decision, particularly if they have additional documentation that would support the patient’s need for inpatient status.