Tracking venture capital investment, if not on the whole by some geography, demands that it be viewed in discrete groupings, such as by technology type. The purpose is, of course, to see the trend, but the underlying assumption is that. from time point A to time point B, the grouping itself has not changed, irrespective of the amount of investment.

Tracking venture capital investment, if not on the whole by some geography, demands that it be viewed in discrete groupings, such as by technology type. The purpose is, of course, to see the trend, but the underlying assumption is that. from time point A to time point B, the grouping itself has not changed, irrespective of the amount of investment.

Why do I bring this up? Well, let’s take a topic like “medical devices”. While there may be some minor debate as to what constitutes a medical device (does it include diagnostic devices?), the majority of people understand what medical devices are.

But what about medical technology–medtech? Is this the same as medical device? Absolutely not. When is medtech not a medical device? How about when it is a polymer-based or biological extracellular matrix for orthopedic applications designed to induce cell growth? How about the fully bioabsorbable cardiac stent? How about liposome-encapsulated drugs? How about drug-eluting stents (considering the cost and value are contributed by both the stent and the drug)? How about topical dressings? Collagen dressings? Cultured skin grafts?

From the standpoint of analyzing markets and market opportunities, it is foolhardy to consider a market to be defined by a very specific technology rather than competing applications. For example, angioplasty, stenting, robotic cardiac surgery, percutaneous CABG and even cholesterol-lowering drugs all compete in the same “market” (treatment of coronary ischemia), regardless of technology.

For the same reason, I do not put much stock (so to speak) in analyzing investment solely in “medical devices”. My interest is investment in medtech. Of course, I am indeed interested in investment in medical devices, but only as the most significant component of medtech.

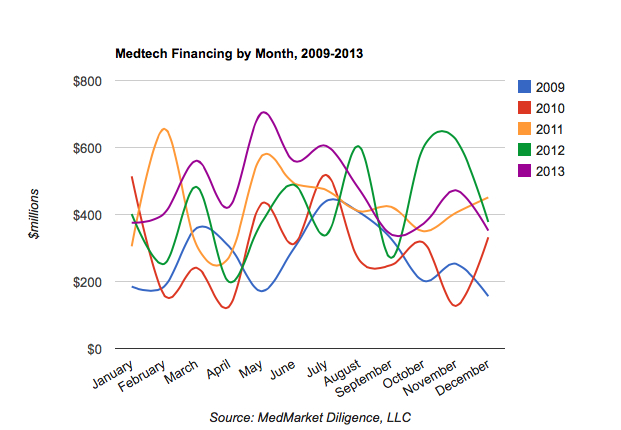

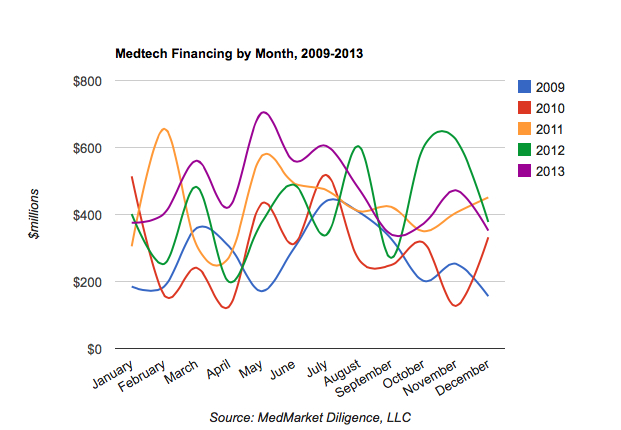

So, when I see reviews (I’m going to pass on specific references, but google for yourself) of 2013 medical device investment, particularly those that point to a decline, I cannot but help point out that such reviews are myopic, considering less than the whole. What I track is the broader medtech, and for 2013 there was a distinct 14% increase in 2013 investment over 2012 investment.

See for yourself and note that, going back to 2009, we have the data on each investment in these monthly totals.