New York State has approved these rates for health insurance on the state exchange.

Here’s Part 3 of our mini-series on the Affordable Care Act and how the health insurance landscape is changing; Part 1 is here; Part 2 is here.

* * * * *

What can you tell me about buying health insurance under the new law? Not too much, please.

Stick with us. This is not too complicated.

The law had a primary goal of expanding health insurance coverage for all Americans with three main strategies:

- Expanding Medicaid coverage, for poor people, up to 138% of the federal poverty level. The Supreme Court decided to let states make their choice on this; only about half the states are expanding Medicaid coverage.

- Setting up health-insurance exchanges to enable consumers to easily compare plans, and subsidizing insurance for people with incomes betwen 138 percent and 400 percent of the federal poverty level

- Requiring everybody with an income above 400 percent of the federal poverty level to buy insurance or pay a penalty.

The health insurance exchanges are designed to make shopping for insurance – a messy, complicated, confusing process – a little more transparent.

If you have not been able to buy coverage because it’s been too expensive, the act is supposed to rectify that by offering subsidies based on income and family size; see the subsidy calculator here.

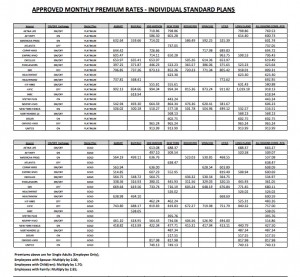

The act establishes categories of coverage. From the most expensive (and the most extensive coverage) to the least expensive and extensive, they are named platinum, gold, silver, bronze and catastrophic. Every company offering, say, a bronze plan in the New York City area must make the same services available, meaning that all bronze plans are comparable. Click on the table here to see the New York plans and rates.

Here’s an easy-to-use graphic from Covered California that shows the out-of-pocket and deductible levels for the different plans. Basically, the more you pay in premiums, the lower your out-of-pocket, co-pay or deductible. Estimates say that the platinum plans are supposed to cover 90 percent of your health spending, gold 80 percent, silver 70 percent and bronze 60 percent.

Catastrophic plans are also available to cover, well, catastrophes. They are available for people under 30, and do not cover routine care. They are also available to people who can certify that they are in a hardship situation — they can’t afford anything else, because they would be required to pay more than 8% of their income for a health plan.

Many insurance companies have chosen not to take part in the exchanges, and are selling their insurance policies separately from the exchanges. While there are many big players off the exchanges in all states, a recent study by the health information company HealthPocket found that the premiums off the exchanges could be cheaper – and yet, those off-exchange policies will not be eligible for a subsidy.

So if you don’t qualify for a subsidy, you might find a better deal off the exchanges.

Wherever you buy, if you buy, pay careful attention to what’s being sold. “Health insurers are showing just how creative they can be at shirking their obligation to provide new consumer protections under the Affordable Care Act,” Sabrina Corlette wrote in a piece about health insurers recently on the blog from the Center for Health Insurance Reforms from Georgetown University.

What is this insurance going to cover?

Ten essential health benefits are supposed to be covered in the platinum, gold, silver and bronze plans offered to individuals and small groups. Here’s a list from healthcare.gov:

- Ambulatory patient services (outpatient care, without being admitted to a hospital)

- Emergency services

- Hospitalization (such as surgery)

- Maternity and newborn care (before and after a baby is born)

- Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

- Prescription drugs

- Rehabilitative and habilitative services and devices (used to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services

To say it’s covered, though, may mean that only 60 percent is covered, or if a provider is out of network, none is covered. Or you’re out of pocket until you meet your deductible, whatever that may be.

The out of pocket maximum: $6,250 for a single policyholder and $12,500 for a family.

Medications: Well, it’s complicated. Anyone who has filled a prescription recently knows that the insurance company can decide what the doctor prescribed isn’t available to you with your insurance coverage. (Here’s our page on buying prescriptions, with tips and tools.)

For the Affordable Care Act, “The final, 149-page rule retains requirements that insurers offer at least one drug per therapeutic category, or the same number as a state’s benchmark plan, whichever is greater. Many state benchmark plans require at least two drugs per class,” Kaiser Health News writes.

“Responding to concerns from some advocacy groups, the final rule also states that insurers must have procedures to allow patients to get ‘clinically appropriate’ prescriptions not on the plan’s list of covered medications.”

Cool tools

If you have not been able to buy coverage because it’s been too expensive, the act is supposed to rectify that by offering subsidies based on income and family size; see the subsidy calculator here.

Want to know the rates in your state? Here’s a handy state-by-state update from Kaiser Health News.

Planning to go without, or wondering if you should? This calculator tool walks you through some of the calculations.

For young healthy people in Portland, The Wall Street Journal walked through some scenarios, showing calculations for all the various plans.

The most important points of the Affordable Care Act, collected into two pages, in a complete once-over-lightly.

Expanding Medicaid

The law also provides for the expansion of Medicaid, the joint state-federal program for the poor, to expand coverage for those who have not had it for various reasons. If you are on Medicaid now, or if you’re not on Medicaid but think you might qualify, go to this page and follow the step-by-step instructions.

Some states have refused to expand Medicaid, a right they were given in the Supreme Court’s ruling in summer 2012. In those states, some of the poorest of the poor will have few options.

_ _ _ _ _

Today’s tip: Pre-existing conditions are not supposed to matter under the new law — you should be able to get insurance anyhow, where before it was prohibitively expensive. Not sure if you have a pre-existing condition? Go to this site and search pre-existing conditions, and you’ll easily find this handy fact sheet explaining what the current situation is, and how it will change as of Jan. 1, 2014 – information that’s useful for people looking for coverage starting Oct. 1.

* * * * *

Next: When am I supposed to buy this health insurance, where and why?