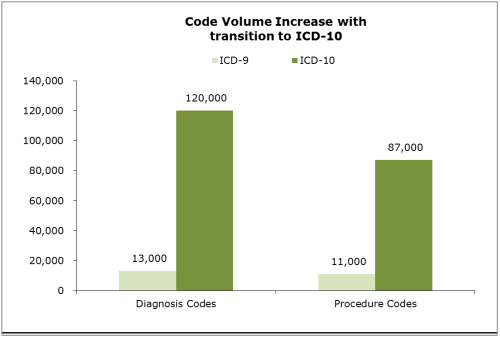

While the deadline for ICD-10 implementation is not until October 2013, the new clinical documentation code set expands over 8x from 24,000 to > 200,000 and with enterprise-wide effects will be one of the most impactful mandates in the history of medical coding.

While the deadline for ICD-10 implementation is not until October 2013, the new clinical documentation code set expands over 8x from 24,000 to > 200,000 and with enterprise-wide effects will be one of the most impactful mandates in the history of medical coding.

According to studies from HIMSS and AHIMA, the majority of provider organizations are lagging in their ICD-10 preparedness. Emdeon also mentioned in their Q1 earnings release that their hospital customers have only recently started to focus on remediating their systems in anticipation of ICD-10.

Under the ICD-10 environment, hospitals will quickly find that their current levels of physician documentation will not support the new mandates, which could pose risks to reimbursement rates. Our significant work in healthcare IT and compliance are underscoring the importance of hospitals aligning now with their physicians so that improved documentation protocols can ease the pain of transitioning to ICD-10.

M&A activity in healthcare IT has been robust as my colleague Seth Kneller illustrated in a recent post. The clinical documentation space in particular was invigorated with the recent announcement of two notable deals:

- Nuance Communications acquired Webmedx: Both Nuance and Webmedx offer transcription services with speech recognition capabilities and natural language processing (NLP) technology. Webmedx proprietary data mining technology, QualityAnalytics™ will enhance Nuance’s clinical language understanding which will allow more clinically intelligent speech-driven conversion of clinical information.

- MedQuist acquires M*Modal: Medquist, a leader in integrated clinical documentation solutions, advanced its opportunity to penetrate the transcription market segment with the acquisition of M*Modal’s advanced speech and natural language processing technologies. M*Modal reported an annual revenue run rate of $24m, and with TEV on the deal reported at $130m, a healthy 5.2x revenue multiple bodes well for the sector.

These two trades are indicative of the market’s anticipation of an increasing focus on clinical documentation due both to meaningful use requirements as well as the likely needs under ICD-10. To the defense of hospital administrators who have seemingly ignored ICD-10 to-date, the funding demands associated with health reform present tremendous challenges; and these executives likely have a few other priorities competing with ICD-10 conversions in their queue including:

- EHR and Meaningful Use: While providers are focusing on EHR templates and spending millions meeting meaningful use guidelines, they would be well served to incorporate ICD-10 into these projects in order to enable documentation now with the specificity necessary for the future.

- HIPAA 5010 compliance: With a deadline of January 2012, crunch time is approaching to meet (yet another) new transaction standard associated with the HIPAA 5010 upgrade (which relates to increased transaction uniformity, pay for performance support, and streamlined reimbursement). AHIMA published a Top 10 list for phase two of ICD-10 preparation which includes step-by-step processes designed to encourage organizations to prepare for ICD-10 in parallel to the migration to 5010.

U.S. hospitals are busy toeing the line on a range of mandates, and if not addressed in parallel with more pressing needs, ICD-10 will by pushed to the bottom of most priority lists.

We believe the most successful provider organizations (e.g. hospitals) will optimize reimbursement levels under ICD-10 and their core business processes around the revenue cycle. As this occurs jointly all boats will rise – enabling higher levels of reimbursement, analytics, quality, efficiency and coordination of healthcare.

Let us know what you think.

Emma Daugherty