My first exposure to Mobisante and their disruptive diagnostic ultrasound system was the mHealth Summit in November of 2010. At that time, the consumerization of medical devices had been gaining traction, mostly in the physician office market.

My first exposure to Mobisante and their disruptive diagnostic ultrasound system was the mHealth Summit in November of 2010. At that time, the consumerization of medical devices had been gaining traction, mostly in the physician office market.

My first exposure to Mobisante and their disruptive diagnostic ultrasound system was the mHealth Summit in November of 2010. At that time, the consumerization of medical devices had been gaining traction, mostly in the physician office market. Consumerization offers medical device manufacturers advantages in lower design costs, shorter time-to-market, lower product costs, increased usability and lower training costs.

My first exposure to Mobisante and their disruptive diagnostic ultrasound system was the mHealth Summit in November of 2010. At that time, the consumerization of medical devices had been gaining traction, mostly in the physician office market. Consumerization offers medical device manufacturers advantages in lower design costs, shorter time-to-market, lower product costs, increased usability and lower training costs.

I recently got Sailesh Chutani, co-founder and CEO of Mobisante, on the phone and we discussed their product strategy — a software based diagnostic ultrasound that runs on a variety of consumer electronics platforms.

Your product is clearly a diagnostic ultrasound medical device, but one can’t help but notice the rather unique design and choice of components. What were the factors driving the eventual design and appearance of your diagnostic ultrasound?

For us, in terms of where we started, our goal was to make ultrasound imaging universally accessible; to democratize it. Currently, there are three very significant barriers to broader adoption of ultrasound imaging: cost, complexity and the difficulty of integration with workflows.

Traditional ultrasounds are the way they are because historically the only way to get the high performance and image quality you need was to do custom hardware, custom everything. This is by necessity very expensive. Then, in 2007, Qualcomm came up with Snapdragon chip sets. Now, for the first time, you had enough computing power in a smartphone to do the processing required for real time ultrasound imaging. So, we were looking at all of that and thinking, “Okay, so what are some the cost drivers?” Doing custom hardware is a pretty major driver of costs. If we could now use commodity electronics as building blocks for these devices, our costs would be dramatically lower.

The second big barrier was that a lot of the complexity you see in traditional devices comes from designs that are kind of one-off designs. And these devices are also designed for highly trained sonographers or experts. Those devices have dozens of knobs and controls. Sometimes weeks of training is required to just learn how to master a conventional ultrasound system. We questioned whether all of that complexity was necessary. Certainly, this complexity is an impediment if you’re going to make the diagnostic functionality more broadly accessible, especially to non-experts. As consumers, all of us are getting trained on the interaction paradigm of smartphones and tablets, so why not just make using ultrasound look like any other application you’d download? Stick to the interaction paradigm that the whole community has been trained on, and leverage that. So now, it takes someone five minutes now to learn to operate the device versus taking three weeks of class.

Breaking the third barrier entailed leveraging the connectivity that comes for free in all of these smart phones and tablets. So, we leverage those connectivity capabilities to offer functionality beyond image capture, but also managing and organizing these images through the diagnostic life cycle. We offer cloud-based image management and then eventually we’ll offer over-read services and analytics. These capabilities simplify integration of our devices into clinical workflows.

Those are the three key insights and drivers we had for our product, and I think you can clearly see them emerge out of the design and the actual product today. We are leveraging commodity smartphones, tablets and other off-the-shelf hardware, focusing on designing a simplified user interface that piggybacks off the training we all have in gestures and touch. The third piece is connectivity and increasing the value of the solution by not just capturing images at the device but also providing image management and access to other complementary services.

It seems that you intended to create a disruptive medical device from the get go? ?

That’s an accurate statement. [chuckle]

Our driver was really, how do you increase access. And maybe I can step back and ask, “Why does this even matter?” If you look at the broader issue, and this is really a global issue, the big question is, “How do you increase access to healthcare and do it in an affordable manner?“

There are two main drivers that determine the cost of healthcare. One is where are you delivering care? Are you delivering care in places like hospitals, in clinics, or in people’s own homes? And the other is who’s delivering that care? Is it highly trained MDs or nurses, nurse practitioners, or community workers or maybe patients themselves?

So, if you can move care closer to the patients, whether it’s a clinic out in the community or their own home, and you can move more of the care delivery to mid-level professionals and eventually patients themselves – if you can move along those two dimensions, that’s where you start to break the cost curve.

The problem is, in order to do that, you need a different kind of medical device or toolbox. Less skilled users need diagnostic and procedural guidance that you don’t have today. Today’s medical toolbox, the diagnostic toolbox included, is designed to be operated in a hospital environment by highly trained professionals. So, in some sense, that’s the problem we wanted to solve, and we picked ultrasound imaging as the tool to focus on first because it has very broad applicability.

Point of care imaging can take the guesswork out of medicine, right? So, you don’t have to palpate or poke to try and figure out what’s happening inside someone’s body – you can image and see what’s happening. That is the driver for what we’re doing. And yes, we also wanted to explore, how do you have a business model that would be difficult for incumbents to copy, and an approach, which as the newcomer, we could pioneer and build into a very strong position in the market?

Your product design has allowed you to carve out a segment of the market that really didn’t exist before.

That is correct. That is correct because, ultimately, if you think about who do we compete with? We compete with non-consumption (pdf), to use Clayton Christensen’s term, right? We are really making ultrasound imaging available to people who either didn’t have access before, had inconvenient access, or couldn’t afford it. Right? So, for them, they’re not looking for the dozens of features of a $100,000 device. They’re looking for something basic that allows them to do triage, quick looks. Essentially, answer yes/no questions.

So, while your disruptive product design significantly reduced the purchase price and per unit revenue for your product compared to traditional ultrasound systems, it sounds like it’s also created new business opportunities and new revenue opportunities?

Absolutely. An example would be, in addition to the imaging device, offering people image management in the cloud. Besides automating the diagnostic workflow, clinics and hospital systems can essentially start to use that to do quality control on the images being acquired. They can use it to do training. Radiologists can start to offer 24X7 over-read services for ultrasounds, which exists in CT and MRI, but is not as prevalent in ultrasound.

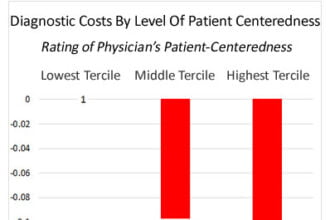

So, yes, you’re absolutely right, you got the new opportunities to provide better care and create new revenue opportunities for us. But, there’s one point I want to highlight. Traditionally, devices have been sold in a fee-for-service reimbursement world. Manufacturers sell big-ticket medical devices justified by the fees health care providers can charge for using the device to do procedures. In this scenario, capital equipment costs are less important than the provider’s revenue potential from procedure fees. Providers have an incentive to do as many procedures as possible because they’re receiving a fee for providing that service. Now with the change in the health care system, the Affordable Care Act, I think people are starting to look at costs, clinical effectiveness and overall value – this creates a very different kind of business environment where you’re looking at tools asking the questions, “Does it help you provide better care? Does it help you provide cheaper care?”

I think that’s the big opportunity for innovation in point-of-care devices because they essentially allow you to do much more effective triage very early to see who needs the more expensive modality or not. For example, you’re at your community clinic in a rural area, complaining of abdominal pain. Today, if they don’t have imaging, they’re referring you to a hospital due to the serious conditions your symptoms might indicate. You want to rule out a whole class of things. If they have a device like ours, they can do it right away, and then for a number of cases, they will be able to have confidence. “Yeah, you don’t need that extra level of screening or diagnosis. You’re fine. You can go home. You just have gas or you ate something that didn’t agree with you.” Early on, in the health care delivery process, it’s possible to really reduce the number of unneeded procedures and screenings that have been the norm, with these point-of-care devices.

Up to this point, we’ve talked mostly about market facing factors that have both driven your design and are a consequence of your design approach. What factors or what kind of impacts were there internally in your company as a consequence of taking this pretty radical approach to medical devices? And I’m thinking things like new core competencies, regulatory impacts, purchasing components, all those kinds of issues.

Oh, it’s huge. It starts with what kind of team do you put in place, right? We needed folks, not only from the medical device community, but people who knew how to operate in this environment where some of the building blocks are off the shelf. The next consideration had to do with what we were going to be building on a platform that would evolve very rapidly. We had to learn to architect our product’s stack, so that it can cope with the rapid change that occurs with consumer electronics without requiring extensive redesign. And then tied to that was “Well, how do we approach our regulatory strategy?” If every time something minor changes, we have to get a new 510(k), you’d go out of business pretty quickly.