I don’t care where you look in Healthcare IT today, everyone has a lot on their plates. The Exchanges for each state are supposed to be online and available for consumers in October of this year, but will they make it?

I don’t care where you look in Healthcare IT today, everyone has a lot on their plates. The Exchanges for each state are supposed to be online and available for consumers in October of this year, but will they make it?

The federal government is now in charge of setting them  up for a large number of states, too. There are two software programs, one from Oracle and one from Microsoft that appear to be packaged to make the job easier, but as we all know there’s a lot of settings and parameters even if off the shelf software is deployed, ask anyone who has installed a few servers. Now the feds would be wise to look into one or both of these, I would think. Here in California we can’t get a payroll software solution working yet that can get it right. $50 million was burned on the project and the total contract with SAP was $87 million and the state remains on the old but dependable Cobol system for now. It’s old technology that sometimes reaching scaling limits, but it’s solid as a rock.

up for a large number of states, too. There are two software programs, one from Oracle and one from Microsoft that appear to be packaged to make the job easier, but as we all know there’s a lot of settings and parameters even if off the shelf software is deployed, ask anyone who has installed a few servers. Now the feds would be wise to look into one or both of these, I would think. Here in California we can’t get a payroll software solution working yet that can get it right. $50 million was burned on the project and the total contract with SAP was $87 million and the state remains on the old but dependable Cobol system for now. It’s old technology that sometimes reaching scaling limits, but it’s solid as a rock.

Oracle Announces Insurance Exchange Platform – Purchasing Health Insurance Platform–Available for State Governments

Microsoft Announces New Low-Cost Turnkey State Health Insurance Exchange Technology Solutions

Now insurers have their work cut out at their end as cross referencing will be needed and a lot of testing back and forth as this is not just new data being entered as people have to be checked for eligibility and make sure they are not already covered under other policies, etc. and a few other details. Who thinks they are going to make it without an extension? When you look at the coding and integration work, there’s a lot of it. (We can just slip this in to the ICD10 ongoing projects somewhere along the line.) We have that happening here in California as well. It makes me wonder what the longevity of the state CTO and CIO might be, but HHS says hurry, hurry, hurry… but you can’t rush development.

Insurers participating in more than one exchange, same thing with data and pricing for each state, too. Doctors worry about payment delays, which is nothing new, but they don’t want them in addition to other payment delays they incur. With integrating this much data and the large number of parameters to be covered, I think we stand to see a lot of flawed and mixed-up data until they are up and running for a while. And, who knows, with new technologies added and data formats, it could go on for quite a while.

Did I mention a testing period? Will there be time for it? Well, someone will have to make some time and this could be a 24/7 hour endeavor by the time October rolls around. And if that doesn’t work, will the government be sending us all to Wal-Mart as an outsourced partner? Walmart wants to be an insurance exchange, too. We have Costco as a PBM now..,

Everybody Wants to be Health Insurance Exchange, Wal-Mart Considering the Idea for Small Companies And Oracle Can Sell You a Software Exchange Platform

Health insurers are embracing the move toward health insurance exchanges, yet they’re concerned about IT infrastructure changes, according to a Feb. 20 report by Edifecs, a health care IT software company.

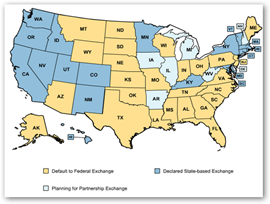

The Obama administration’s Affordable Care Act calls for states to implement the exchanges, referred to as HIXes, by October 2013 or have the federal government implement them on their behalf. The Web-based exchanges allow small businesses or uninsured individuals to purchase health insurance.

However, 88 percent of respondents are concerned about disruptions to their current IT enrollment infrastructure and processes when they join an exchange. Insurers will have to create new business processes and integration points rather than simply add new data from individuals and small businesses, according to Jamie Gier, vice president of corporate marketing at Edifecs.

“It goes beyond simple data feeds,” Gier told eWEEK in an email. “Beyond integrating their systems with federal and/or state exchanges, insurers will need to reconcile their detailed member records with those maintained by the exchange on at least a monthly basis.”

Insurers must manage and reconcile their membership records between their own insurer systems and HIXes, said Gier. This cross-checking of data will confirm eligibility and credit premiums, as well as ensure correct payments, said Gier.

http://www.eweek.com/enterprise-apps/health-insurance-exchanges-bring-concerns-of-it-disruptions-survey/