Bangladesh is going digital. Not in smart watches, sensor-based clothing or electronic health records, but in money. Mobile money. Money, that according to BRAC and the Gates Foundation could improve the economic and health outcomes of the country, especially of women and children.

Bangladesh is going digital. Not in smart watches, sensor-based clothing or electronic health records, but in money. Mobile money. Money, that according to BRAC and the Gates Foundation could improve the economic and health outcomes of the country, especially of women and children. With a healthy appreciation of the complexities in scaling digitally, faith in innovation at the grassroots level and years of planning, these organizations just might make mobile money the future of finance.

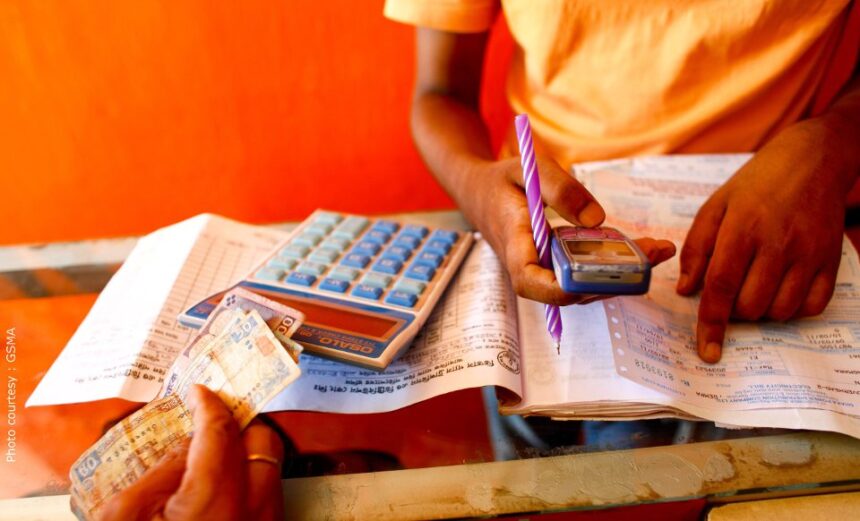

Throughout the country, like all countries in the world, there are citizens that are “unbanked,” meaning that they do not possess a bank account and cannot share funds person-to-person, even within families, without cash. For these people, a significant portion of Bangladesh’s population (estimated 70%), access to formal financial services for starting businesses, paying for children’s education and health services, and paying salaries for community health workers could translate to millions of improved and saved lives.

For Bangladesh’s large rural population, transportation and infrastructure challenges, combined with a weak banking infrastructure, financial inclusion remains a tall order. However, increases in cell phone utilization in these areas mean that mobile money – instead of cash – could make payment to individuals, schools, health care providers and businesses seamless and easily accessible.

Digital Money

It is well documented and understood that men and women accumulate and spend money differently. For example, women earn smaller, more regular streams of income than men. Further, globally, women tend to have less ownership of cellphones due to allocating their finances for shelter, nutrition and education, almost always for children first. However, those kinds of investments do not lend themselves to establishing credit, building a business or maintaining a bank account.

Innovation, often coming from those in greatest need, has taken root throughout Bangladesh – with women center stage in development. This trend has also been seen in countries such as Kenya and Tanzania, where mobile money has a successful track record, and presently accounts for more than 50% of adult transactions in those countries. In Kenya, for example, one study concluded that households that adopted M-PESA, their most popular mobile money system, saw incomes increase by 5-30%.

BRAC, a Bangladesh-based organization working in 12 countries, “is no stranger to taking radical ideas to scale,” says Maria May, senior program manager for the BRAC Social Innovation Lab. And, with growing acceptance by international organizations including the World Bank that, “digitizing payments, transfers and remittances contributes to women’s economic empowerment,” support for such efforts has been moving quickly since 2010.

In 2014, BRAC announced its first Innovation Fund for Mobile Money Challenge, in which seven winners were selected from over 100 submitted ideas. From those, initiatives such as Mobile Micro-Insurance to secure low premiums on insurance and Honorarium Disbursements to Community Health Workers through the health, nutrition and population programme were approved to lead the way. Additionally, mobile insurance for credit shielding has been established at 20 branches, while exploring opportunities to offer additional types of insurance in 2015.

The Bill and Melinda Gates Foundation also committed its 10th Grand Challenge to “Putting Women and Girls at the Center of Development,” with a strong focus onfinancial services. Because significant correlation exists between empowering women and improved outcomes in health, agriculture and finance, the goal of the Challenge is to “accelerate discovery of how to most effectively and intentionally identify and address gender inequalities and how this relates to sectoral outcomes; scale-up approaches known to work.” And to date, mobile money is working.

Mobile Technology Makes Access Possible

Although there is great promise in mobile financial services, there are significant up-front and maintenance costs. However, Bangladesh presents a unique environment in South Asian in which to test the potential programs. Not only does Bangladesh boast a strong microfinance market, but it also has access to more mobile devices and accounts than other South Asian countries. In 2014, cell phone ownership in Bangladesh on GrameenPhone alone is over 50 million strong in a country with 160 million people.

Between 2011 and 2014 there have been two networks that emerged as strong frontrunners in the mobile money market: bKash and Dutch Bangla Mobile, of theDutch Bangla Bank. While these entities have a combined 75 million customers, bKash has cornered a significant portion of the market. Like many other marketsaround the world though, Bangladesh is still waiting on international remittances and cashing out from mobile phones.

Nevertheless, it is widely accepted that mobile money will develop organically with person-to-person transfers followed by scaling to formal providers, and that countries around the world are hungry for the opportunity. As the trend continues, the ability to access mobile money can empower women one at a time to fund their own work, pay for their family’s educational and health needs, and for community workers to receive payment for their services. Whether small or large scale, the ability to bank the unbanked and transfer funds, could change education, health and wellness around the world in ways other digital health products cannot.

As an early step, BRAC University’s Institute of Educational Development, also part of BRAC’s Innovation Fund for Mobile Money, is transitioning to mobile-based payments for its secondary schools. Its director, Erum Mariam, has big plans for going digital. “I think this is an excellent pilot since it ensures transparency. I have asked my group to explore the possibility of the mobile transaction for providing teachers’ salaries as well.”

Additional, personal stories from bKash recipients can be found on the website.