Cancer affects many of us, whether directly or indirectly. In today’s society, it’s not uncommon to hear of someone being diagnosed with cancer. Sadly, it happens pretty frequently. However, science is constantly expanding and introducing new treatments. One cancer treatment in particular is CAR-T-cell therapy.

CAR-T-cell therapy is an immunotherapy treatment used to get rid of cancerous cells. T-cells are a type of white blood cell that helps fight infections and cancer. These specific cells help attach to cancerous cells to destroy them. However, cancer cells can adapt and mutate, making it difficult for T-cells to carry out their purpose. This allows the cancer cells to spread, and that’s when CAR-T-cell therapy can be helpful.

How CAR-T-cell therapy works

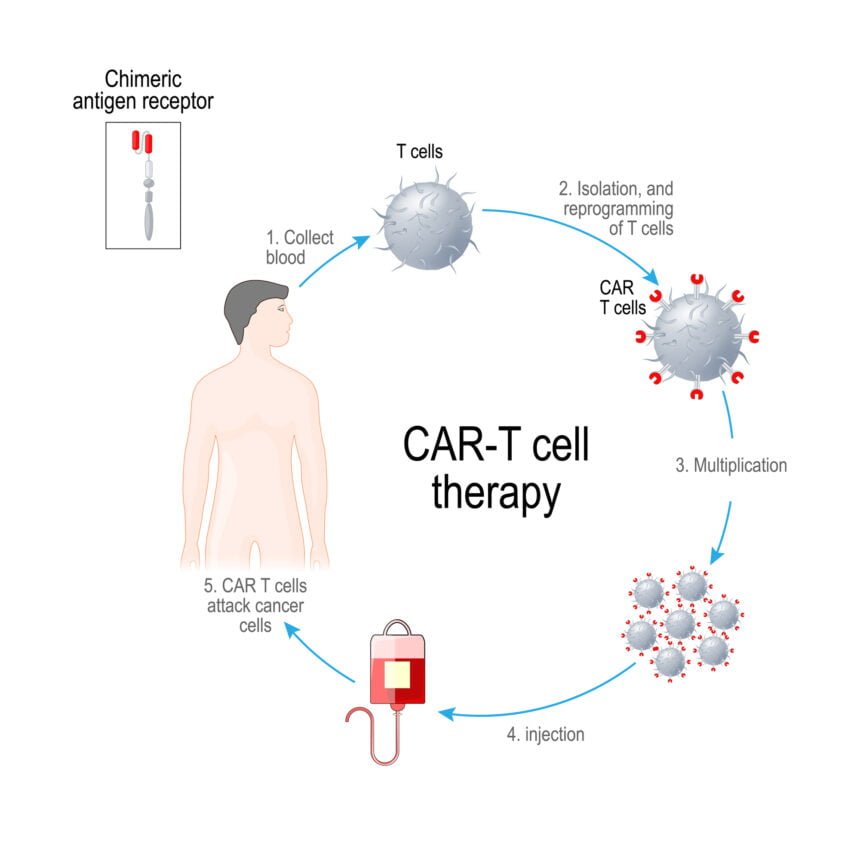

If the doctor recommends this treatment, the cancer patient will give their blood so the lab can extract and collect their T-cells. Once the lab has the patient’s T-cells, they use modified, inactive virus cells to introduce genetic information into the T-cell. This helps reprogram the T-cells to produce special receptors called chimeric antigen receptors or CARs. These receptors are on the surface of the T-cell and allow the T-cell to penetrate cancerous tumor cells.

Once the T-cells have the CARs, they are injected back into the patient to destroy the cancerous cells.

Ultimately, CAR-T-cell therapy aims to stop the spread of cancerous cells, but it uses your own immune system.

When does someone need CAR-T-cell therapy?

CAR-T-cell therapy is often approved and used to treat lymphomas, blood cancers like leukemias, and, recently, multiple myeloma. If you have a recent diagnosis, you will want to discuss your treatment options with your doctor to find the proper treatment for you.

Does Medicare cover this therapy?

According to the CDC, the risk of cancer increases with age. That’s why it’s important to know how your health insurance will cover cancer treatments and related services. Most people 65 and older have Medicare insurance, which is significantly different from employer insurance or private insurance. Understanding Medicare, how it works, and what it covers is crucial as you age.

Medicare covers autologous cancer treatment with CAR-T-cell therapy when performed in an outpatient setting. The healthcare facilities that administered this treatment must be enrolled in the FDA risk evaluation and mitigation strategies.

How does Medicare work?

Most people become Medicare eligible at age 65, but you can qualify for Medicare earlier if you have certain disabilities. Original Medicare is made up of two parts that the federal government provides: Part A (hospital coverage) and Part B (medical coverage).

Since the federal government provides Original Medicare, the coverage is the same for every Medicare beneficiary.

If you are not actively working for a large employer at 65, you will want to enroll in Medicare to avoid a late enrollment penalty. You can apply for Medicare as early as three months before your 65th birthday month or as late as three months after.

However, Original Medicare does not cover all of your hospital and medical costs. You are left with out-of-pocket costs without a cap or limit, so you will want to consider enrolling in a Medicare Supplement plan or a Medicare Advantage plan to help with your potential costs. You’d pay for these plans in addition to your Original Medicare.

What part of Medicare covers CAR-T-cell therapy?

Cancer treatment and immunotherapy is an outpatient medical service. When you receive treatment in an outpatient setting, such as a doctor’s office, clinic, or facility. This means your CAR-T-cell therapy would fall under Medicare Part B. Although Medicare covers this treatment, you still have out-of-pocket costs.

How much does this treatment cost with Medicare?

With most Medicare Part B services, the Part B deductible will apply. In 2024, that deductible is $240. Once that deductible is met, Medicare Part B covers 80% of the cost of your services. This leaves you responsible for the remaining 20%. Since you are paying a percentage of the cost of the service, your out-of-pocket might vary depending on where you get your treatment.

However, it’s important to know that there is no cap on your cost-sharing with Original Medicare. Most beneficiaries enroll in a Medicare Supplement plan, or Medicare Advantage plan, to help limit out-of-pocket costs.

How Medicare Supplement plans help with costs

If you enroll in a Medicare Supplement plan, it pays secondary to Original Medicare. Therefore, it will help pick up your remaining balances, such as the 20% coinsurance. However, you’ll want to understand a few things about Supplement plans:

- They must pay if Medicare pays.

- A doctor or facility that accepts Medicare must accept your Supplement plan if they accept Medicare.

- Medicare Supplement plans have a premium you’d pay in addition to Original Medicare

- You’ll want to enroll in a Part D drug plan to cover your medications.

- You purchase a Supplement plan from a private insurance company.

How Advantage plans help with costs

An Advantage plan must offer the same benefits you’d received from Original Medicare. When you enroll in an Advantage plan, you choose to receive your Medicare benefits from the insurance carrier and not the federal government. This means your service costs will differ from those with Original Medicare.

Each service with an Advantage plan has a set copay or coinsurance that you are responsible for, and the copay or coinsurance varies with each plan. For example, an office visit with your primary care physician may have a $30 copay.

However, since an Advantage plan has more out-of-pocket costs than a Supplement plan, Advantage plans include a maximum out-of-pocket limit, which helps cap your costs for approved services.

Wrapping up

Medicare Part B and Medicare Advantage plans can cover CAR-T-cell therapy for certain cancers as long as it meets their guidelines. You’ll want to evaluate your plan for more information on how much it may cost you and if there are any restrictions.