(Editor’s Note: Dan Munro writes for Forbes.com under the heading “HealthCare Compass”)

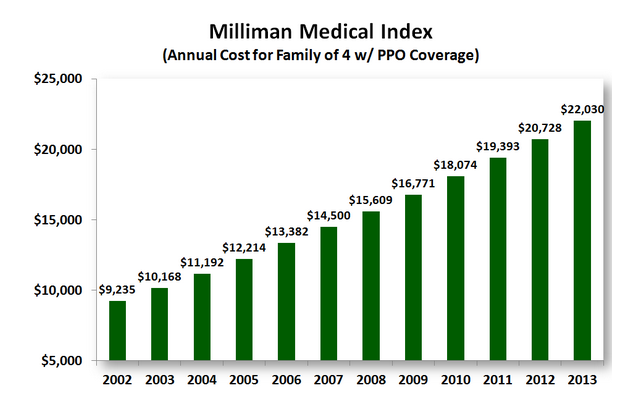

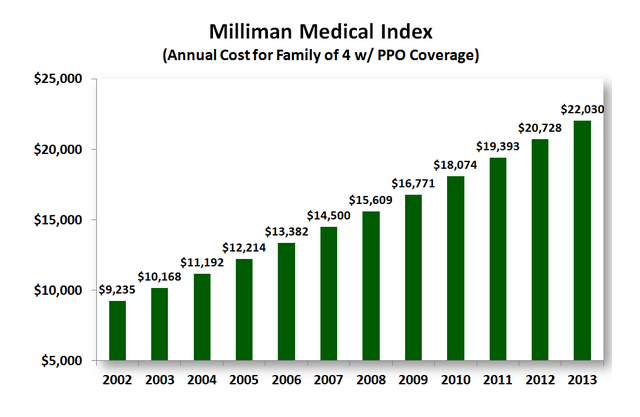

It’s that time of year for our annual check-up with the folks at Milliman. We’ll cut to the chase – it’s not good news. The full report is available (here) and the chart for annual healthcare costs for a fictional family of 4 (with a PPO) for each of the last 11 years looks like this:

(Editor’s Note: Dan Munro writes for Forbes.com under the heading “HealthCare Compass”)

It’s that time of year for our annual check-up with the folks at Milliman. We’ll cut to the chase – it’s not good news. The full report is available (here) and the chart for annual healthcare costs for a fictional family of 4 (with a PPO) for each of the last 11 years looks like this:

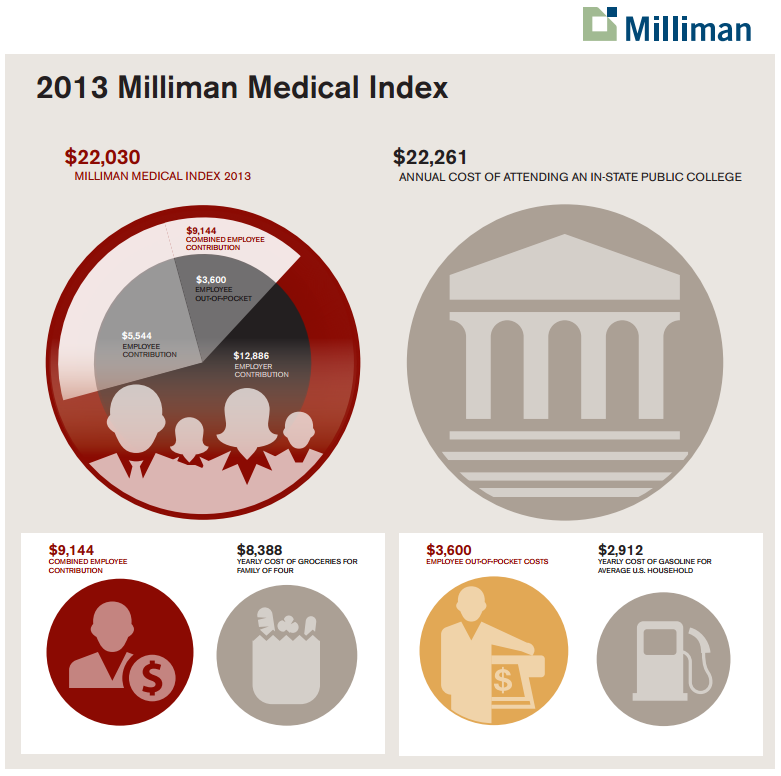

Of the $22,030 healthcare cost for a family of four, the employer pays about $12,886 in employer subsidy while the employee pays the remaining $9,144, which is a combination of $5,544 in payroll deductions and $3,600 in employee out-of-pocket costs. For employees, this represents a cost increase of 6.5% over last year’s total employee cost of $8,584.

You may recall from our coverage last year that the figure for 2012 ($20,728) compared almost exactly with the cost of a new model sedan from Chevrolet – the Cruze (here). This year, Milliman has elected to compare the figure ($22,030) to the annual cost of attending an in-state public college (a difference of only $231):

They’ve also updated the graphic to more easily represent the annual cost by component. The three basic components are:

1) Employee Contribution to health insurance ($5,544 payroll deductions)

2) Employee out-of-pocket Expense ($3,600)

3) Employer Contribution ($12,886)

Milliman also compared the total employee contribution with groceries for a year (slightly more) – and then the out-of-pocket employee expense with the yearly cost of gasoline for the average household (also slightly more).

There was a lone bright spot:

“For the second consecutive year, the increase over the prior year on a percentage basis was the lowest in the history of the study—and yet the total-dollar increase still exceeded $1,300 for the fourth year in a row,”said Lorraine Mayne, principal and consulting actuary with the Salt Lake City office of Milliman.

I wish there was better news here – there isn’t. Regardless of the fiscal debate around healthcare costs – the net effect to a family of four remains a huge challenge and a big part of the family budget. Unless and until this number stops going up – we’re not making the progress we need on either the technology side or the legislative side of healthcare transformation. In the end – those are the only two levers we have to bend the cost curve.