First Published in MedCityNews

First Published in MedCityNews

“The key (angel investing) trends over the last few years have been syndication and broader geographic distribution of investment; both of which suggest that attractive new ventures are finding places to start all over the country,” says Rob Wiltbank, vice chairman of research for the Angel Resource Institute, referring to new angel investing data released today.

A few other interesting points emerged in the latest Halo Report, a quarterly survey of angel group investment activity compiled by the Angel Resource Institute, Silicon Valley Bank and CB insights.

The median size of rounds has trended up over the last year

But the mean deal size has done the opposite, dropping from $860K to $800K. The median round is smaller at $680K, suggesting that a small number of significantly large deals offset the mean. Perhaps those deals are dropping in size because…

Three in four deals involving angel groups are syndicated

When angels co-invest, median round size is $1.5 million. That number has held relatively steady over the past five quarters.

Heavy activity outside of Silicon Valley and Boston

VCs might love San Francisco and New England, but nearly three-quarters of angel group deals are done in other locales. For the first time, more angel dollars were invested in the southwest than in California, according to the Q1 report. (For a good anecdote, see the story of a Texas pharmaceutical startup that raised $16 million from angels). Companies in the Great Plains region and New York saw the largest increase in angel group deals over the last year.

More angel groups are doing healthcare deals

Healthcare accounted for a greater percentage of all angel deals (19 percent) and dollars (23 percent) than it did over the first quarter of last year.

The big bucks

These groups have invested the most dollars per deal over the past year: Golden Angels Investors, (Milwaukee), Golden Seeds. Houston Angel Network, Jumpstart New Jersey Angel Network, Nashville Capital Network, Oregon Angel Fund, Tech Coast Angels (California).

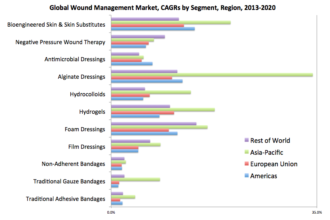

[Chart and infographic from the Halo Report]