There are presently massive shifts occurring in the competitive global landscape of health, and particularly in the life sciences. As we approach 2015, it is imperative that leaders in the health space understand the trends and shifts happening around them, not only in the US, but also in international markets, cities and service lines.

There are presently massive shifts occurring in the competitive global landscape of health, and particularly in the life sciences. As we approach 2015, it is imperative that leaders in the health space understand the trends and shifts happening around them, not only in the US, but also in international markets, cities and service lines.

With unparalleled connectivity, evolving demographics, impressive growth in patent applications in emerging markets and pharmaceutical demand changes worldwide, there is no doubt that hospital leadership, policymakers, manufacturers, inventors and clinicians in America need to know what is in the pipeline for 2015 and beyond. Using the 2014 Global Life Sciences Cluster Report from JLL, here are the top 7 trends you need to know for success in 2015.

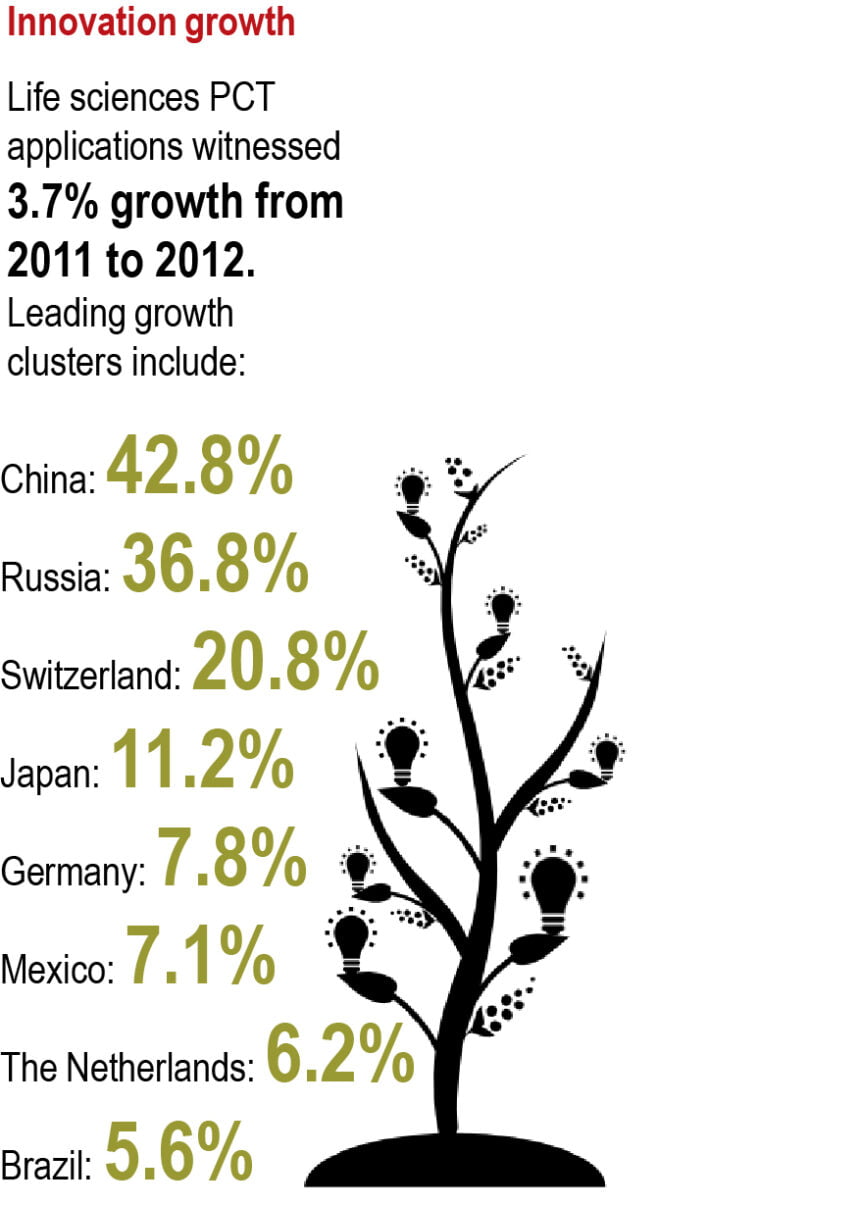

- Global Innovation: While both North America and Europe continue to have the most life science Patent Cooperation Treaty (PCT) applications per year (41% and 31% share, respectively), major shifts are occurring. PCT applications, an international measure of innovative output, in Asia, Latin America and the Caribbean are increasing, with the gap forecasted to continue closing. This trend, in part, can be attributed to the shift from broad, chronic disease biological maturity in developed countries to developing countries. In turn, many advanced cities and companies are transitioning to specific, personalized biologics and care. For example, biosimilars are taking root in the US and EU, while diabetes has become a primary focus of the Middle East and North Africa.

- An Aging Workforce And Population: Between 1993 and 2010, the percentage of the scientific and engineering workforce over the age of 50increased from 20% to 33%. Further, before 2020 it is estimated that 2 million engineering and life science jobs will become open, mostly due to retirement. Per the 2014 ManpowerGroup’s annual global survey of 38,000 employers in 42 countries, 35% of employers report difficulty in filling jobs. Of those, 54% report this difficulty in filling jobs has a direct impact on their ability to meet client needs. For example, in China, the one-child policy has made the current health care workforce unable to manage its aging population, a problem Intel is hoping to solve. With the aging of America’s workforce compared to youth in developing countries, Harvard Business Review contributors have suggested “retiring retirement” in the US. Flexible work hours, new technology, new training programs and varied skill sets are going to cause major shifts in corporate America, especially within the health ecosystem in areas such as pharma and medical device. While STEM (science, tech, engineering and math) programs targeting women have become increasingly popular in the US, females are still greatly under-represented in this area (only 23% of the engineering workforce in 2008), and could possibly help meet health and tech demands.

- Regulation And Taxation: Not surprisingly, Japan and the United States have the highest corporate statutory tax burdens (39.5% and 39.1%, respectively). While many argue this drives down innovation, others claim it merely keeps companies from having investments in the US. For example,Medtronic recently committed to purchasing Covidien, with speculation that the move is to keep funds in Ireland, with its low tax rate. However, the US and Japan also have some of the best regulatory systems and high political and transparency rates in the world, making production and sales easier for many. And, according to Roger Humphrey, Executive Director of JLL’s Life Sciences group, “Federal policy, such as corporate tax structures and regulatory frameworks, directly impacts life sciences companies’ ability to establish roots and flourish over time.”

- Education: The highest percentage of the working population (25-64 years old) with bachelor’s-type degrees still belongs to the United States. However, that can no longer be said for younger generations. For example, the percentage of 25-34-year-olds with bachelor’s degree is higher in Korea (39%), The Netherlands (38%), the United Kingdom (38%) and Australia (34%) than in the US (33%). According to the OECD 2011 Report, “Because of the rapid expansion of tertiary education both in the industrialized world and in emerging economies, the US is fast losing its advantage.”

- R&D Funding And Concentration: Presently, 10 countries account for80% of global R&D. Because businesses are the biggest source of R&D funds, investor confidence and broader economies can have major impacts on funds appropriated for both research and development. However, The Burrill Reportclaims confidence in biotech seems to have returned, with 2013 being a banner year for life science IPO activity in the US with 52 deals resulting in $7 billion, compared to $1 billion for 16 deals in 2012. However, on a country-level, by the early 2020’s, China’s R&D spending could surpass that of the US.

- Declining Barriers For Entrepreneurs:Barriers to entry in entrepreneurship have declined in most countries, especially among the more developed global cities. This is in contrast to the emerging life sciences clusters. Mr. Humphrey notes, “We are consistently seeing that the countries with the lowest barriers to entrepreneurship are the UK and The Netherlands, while China and India presently have the highest barriers to entry.” He claims this is due to difficulties with collaboration and the shared risk models in these emerging markets.

- Differences In Labor Productivity: Between 2003 and 2012, there was a 5% increase in the labor productivity in developing countries, compared to a 1% increase in labor productivity in developed countries. This measure indicates how many goods and services are produced in one hour of labor, and therefore, a continued trend (tracked since 2007) consistently shows that year-over-year shifts in labor productivity are benefiting developing countries. As wealth grows, so too does opportunities to produce specialization and cost-effective output.